Ca Sales And Use Tax Calendar 2022

Ca Sales And Use Tax Calendar 2022

Affiliate Course Calendar. Monthly Motor Fuel Suppliers Report. 2021 Tax Calendar This Tax Calendar has been prepared by the Tax-Client Accounting Services CAS group of Isla Lipana Co the Philippine member firm of the PwC network based on relevant laws rules and regulations issued as of 31 October 2020 by various government agencies. The table calculates use tax based on your California Adjusted Gross Income AGI and can only be used for purchases less than 1000.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

You use give away store or consume the item in this state. November periods are usually due on December 31. Quarter-Monthly Withholding and Sales Tax Payment. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF Guides.

Filing Dates for Sales Use Tax Returns.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

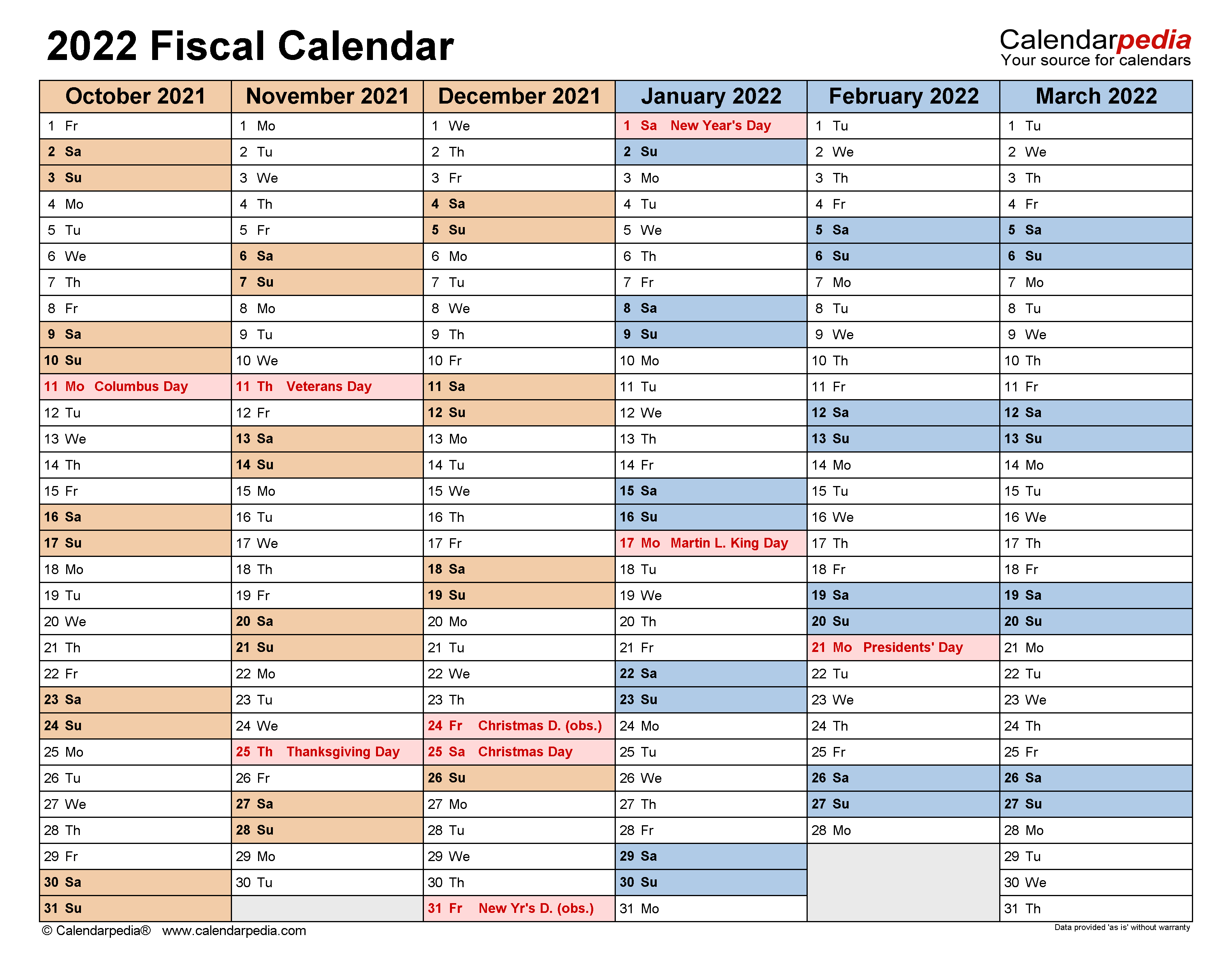

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.htmlCa Sales And Use Tax Calendar 2022. On this page we have compiled a calendar of all sales tax due dates for California broken down by filing frequency. The mission of the California Department of Tax and Fee Administration is to serve the public through fair effective and efficient tax administration. Current Tax Rates Tax Rates Effective April 1 2021 Find a Sales and Use Tax Rate by Address Tax Rates by County and City Tax Rate Charts Tax Resources The following files are provided to download tax rates for California Cities and Counties.

Because 2020 was a leap year any return tax payment or other required action is not due until January 3 2022. A quarterly return is due on the last day of the month that follows the quarter. If you are responsible for a return that is not listed in this calendar please refer to the.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

View Notification Login Welcome My Account. The undersigned certify that as of June 28 2019 the internet website of the California Department of Tax and Fee Administration is designed developed and. If you are responsible for a return that is not listed in this calendar please refer to the. A quarterly return is due on the last day of the month that follows the quarter.

Source: https://www.avalara.com/taxrates/en/state-rates/california.html

Yearly calendar showing months for the year 2022. Because 2020 was a leap year any return tax payment or other required action is not due until January 3 2022. UZ-50 Combined State Sales and Use Tax Urban Enterprise ZoneUrban Enterprise Zone Impacted Business District Sales Tax. Calendars online and print friendly for any year and month.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

Use tax does not apply if you paid sales tax. Sales and Use Tax Forms and Publications Basic Forms. Monthly Motor Fuel Distributor Report. E-Filing and e-PaymentFiling and payment of 1600 VATPT withheld for April 2021.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

The use tax generally applies to the storage use or other consumption in California of goods purchased. Sales Use Tax in California. Monthly Sales and Use Tax Return. Sales Tax Tips.

Source: https://caportal.saginfotech.com/blog/cmp-08-due-date/

E-Submission of sales report. Do You Need a California Sellers Permit. Careers in Oral Health. On this page we have compiled a calendar of all sales tax due dates for California broken down by filing frequency.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

1788 rows California City County Sales Use Tax Rates effective April 1 2021. Kindergarten Oral Health Requirement. Due date for issue of TDS Certificate for tax deducted under Section 194M in the month of March 2021 15 May 2021 - Due date for furnishing of Form 24G by an office of the Government where TDSTCS for the month of April 2021 has been paid without the production of a challan 15 May 2021 -. United Kingdom 2022 Calendar with British holidays.

Source: https://www.cdtfa.ca.gov/lawguides/vol1/sutr/sales-and-use-tax-regulations-art3-all.html

Monthly Tire and Battery Fee Return. Oral Health Fact Sheets. An ePayment direct debit must be made by 4pm CT on the due date to be considered timely. Although many forms are listed it is not all-inclusive.

Source: https://taxguru.in/chartered-accountant/corporate-due-date-calendar.html

The seller does not collect California sales or use tax. Current Tax Rates Tax Rates Effective April 1 2021 Find a Sales and Use Tax Rate by Address Tax Rates by County and City Tax Rate Charts Tax Resources The following files are provided to download tax rates for California Cities and Counties. New Jersey Tax Calendar January 1 2021 December 31 2021 This calendar is for use by both businesses and individuals. Purchases of 1000 or more use the Use.

Source: https://taxguru.in/income-tax/tds-rate-chart-fy-2021-2022-ay-2022-2023.html

Monthly sales use and gross receipts tax return and payment are due for November 2021. Your California Sellers Permit. Dining and Beverage Industry. The mission of the California Department of Tax and Fee Administration is to serve the public through fair effective and efficient tax administration.

Post a Comment for "Ca Sales And Use Tax Calendar 2022"